N26 You

A debit card for everyday and travel

A premium account for your daily needs and travel abroad—without the hidden fees. Open your bank account, and get an N26 debit card in your choice of color.

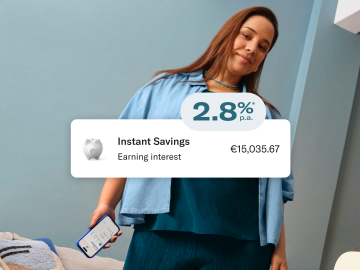

Start earning interest

No deposit limits,** simple conditions, and full flexibility. Discover N26 Instant Savings, the easy-access savings account available at no extra cost in the N26 app.

N26 You customers get 2.8%* p.a. interest on their savings. Prefer 4%* p.a.? Choose N26 Metal.

More about the Instant Savings accountA Mastercard debit in a choice of colors

Get a contactless debit card in a choice of 5 colors—Ocean, Sand, Rhubarb, Aqua or Slate.

Manage your money with Spaces sub-accounts

Stay on top of your finances with 10 Spaces sub-accounts, each with its own IBAN. Easily pay bills via direct debit, set up standing orders for recurring payments, send SEPA bank transfers, and receive money—right in each sub-account.

Keen to save instead? Instantly put money aside to a space from your main account to avoid spending it, or save together with up to 10 others in a Shared Space. To reach your goals even faster, turn on Round-Ups and save up the spare change whenever you pay by card.

Discover SpacesNeed an extra card? No problem.

Losing your card and waiting for a new one to arrive is annoying—that’s why keeping a spare makes a lot of sense. Order a second Mastercard to use with your account right in the N26 app, and make sure you always have access to your cash.

Read more

Take it further with N26 Perks

Enhancing your day-to-day, your N26 You bank account comes with selected offers and discounts from brand names like GetYourGuide and Hotels.com. Carefully curated with you and your personal lifestyle in mind, these N26 Perks are continuously evolving—just open your app to see what’s currently available to you.

Emergencies when travelling

The N26 You policy provides cover for you, your spouse and children in case of a medical emergency while traveling, with access to 24/7 medical phone assistance. This includes emergency dental insurance.

Baggage coverage and delay insurance

Get covered up to €500 for baggage delays over 4 hours, or up to €2,000 if your baggage goes missing.

Travel delay and cancellation

We understand what it's like when when business trips don't go according to plan. Thankfully, if your trip is cancelled or delayed for more than 2 hours, you’ll be covered.

Trip interruption

Get covered up to €10,000 for unused non-refundable trip costs, plus additional accommodation and transportation.

Fee-free ATM withdrawals, and foreign currency payments

With N26 You, you can wave goodbye to foreign transaction fees. Withdraw cash for free in any currency from ATMs around the globe, and pay using your Mastercard debit online and in stores—no hassle, no hidden fees. You’ll also benefit from the Mastercard exchange rate, without any sneaky markups.

Emergencies when travelling

Travel medical insurance up to €1,000,000 for you, your partner and kids in case of emergencies, including dental and winter sports***.

Personal liability while traveling

Coverage up to €500,000 for Travel Liability in case you’re legally liable for damage to a third party or their property during a trip.

Customer Support, here to help!

Need urgent support right away? Don’t worry—our Customer Support team is always on hand to help. You can reach our specialists directly via the N26 app, or the WebApp chat, or visit the Support Center to find a quick answer to your question.

Visit our Support CenterThe world is at your fingertips

For €9.90 per month, open your N26 You account and get a shiny new Mastercard debit card. Make payments at home or abroad without hidden fees, while enjoying an extensive insurance package.

Frequently asked questions

What are the benefits of an N26 You account?

N26 You is a premium membership bank account that comes with a colorful debit card, travel insurance and cover for flight, luggage and curtailment delays as well as luggage loss. You’ll also get exclusive partner deals and free foreign currency ATM withdrawals worldwide. See T&C’s for full details and availability.

How do I open an N26 You bank account?

To open an N26 You account, you must meet our eligibility criteria. If you do, simply register on our website, or by downloading the N26 app onto a compatible smartphone. Opening an account takes only minutes and is done without paperwork. Once you’ve verified your identity, your bank account will be ready to use.

For more information on opening an N26 You bank account, as well as the documents that you need, visit our Support Center.

What do I need to open an N26 You bank account?

You can open an N26 You account via the N26 app on your smartphone or the web app. You’re eligible if:

- You’re at least 18 years old

- You’re a resident of a supported country

- You have a compatible smartphone

- You don’t already have an account with us

You will also need to provide a supported ID document, applicable to the country you’re resident in.

Is the N26 You Mastercard a debit or credit card?

The N26 You Mastercard is a debit card, which means all transactions occur in real-time and are directly debited from your N26 bank account when you make a purchase.

How do I get a debit card?

You’ll automatically receive your N26 Mastercard debit once you have opened your account and that your identity has been verified. You will be first asked to choose the color of your N26 You card, available in 5 colors—Ocean, Sand, Rhubarb, Aqua and Slate.

The N26 debit card will then be shipped to your home address with standard or express delivery.

How much does the N26 You bank account cost?

An N26 You bank account costs €9.90 per month.

What kind of travel insurance does the N26 You bank account offer?

N26 You comes with an extensive insurance package, provided by Allianz Assistance. This includes coverage for travel and baggage delays, medical cover in case of emergencies abroad and much more.

Do you charge foreign transaction fees?

We don’t charge an exchange rate fee if you pay with your Mastercard or withdraw cash in foreign currency.

What are the differences between the N26 You bank account and N26 Business You bank account?

N26 You is a personal account, not to be used for business purposes. In comparison, N26 Business You is a business account for freelancers and the self-employed, who also benefit from 0.1% cashback on purchases in addition to all the benefits of N26 You. At the moment, it’s only possible to hold one bank account per person with N26.

What are Spaces sub-accounts, and how can I use them?

N26 Spaces are sub-accounts that sit alongside your main account, giving you an easy way to manage your finances. As a premium customer, create up to 10 Spaces sub-accounts with IBANs in an instant, and effortlessly put money aside for your savings goals, upcoming expenses, or even an emergency fund. Of course, how you use your spaces is up to you—it’s not necessary to add an IBAN to each space if you don’t need one.

With unique IBANs for each Spaces sub-account, you can receive SEPA bank transfers and pay via direct debit—right from each space. Try using Rules to automatically set your bill money aside to a space, then pay via direct debit from your sub-account. With your monthly expenses taken care of, you can relax knowing that you won’t overspend in your main account.

If you want to save and spend as a group, simply create a Shared Space, and manage funds together with up to 10 other N26 customers. However, please note that an IBAN cannot be added to a Shared Space for now. Stay tuned for more updates to come! Find out more about Spaces and Shared Spaces here.

*The interest rates are based on your N26 membership: 2.8% for Standard, Smart, and You, and 4% for Metal. The interest rates are variable and subject to change in the future. Interest rates p.a. are equivalent to AER in Ireland and TANB in Portugal (before taxes).

**The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

***Legal Notice: You can see all the information you need to start a claim or call Allianz Global Assistance Europe in case of an emergency in the N26 app. N26 You features comprehensive insurance coverage from Allianz Global Assistance Europe (trade name of AWP P & C.S.A - Dutch branch) one of Europe's most trusted insurance companies.

***Legal Notice: You can see all the information you need to start a claim or call Allianz Global Assistance Europe in case of an emergency in the N26 app. N26 You features comprehensive insurance coverage from Allianz Global Assistance Europe (trade name of AWP P & C.S.A - Dutch branch) one of Europe's most trusted insurance companies.

Mastercard offers a range of complimentary privileges as part of your N26 You World card status. Every N26 You card holder is automatically entitled to enjoy these benefits, tailored to the needs of frequent travelers and globe-trotters.

If you are planning your next trip, also make sure to check out the Mastercard Priceless Cities* for exclusive events and recommendations. You only need your Mastercard to discover the most beautiful cities in the world, and your new experiences can begin.